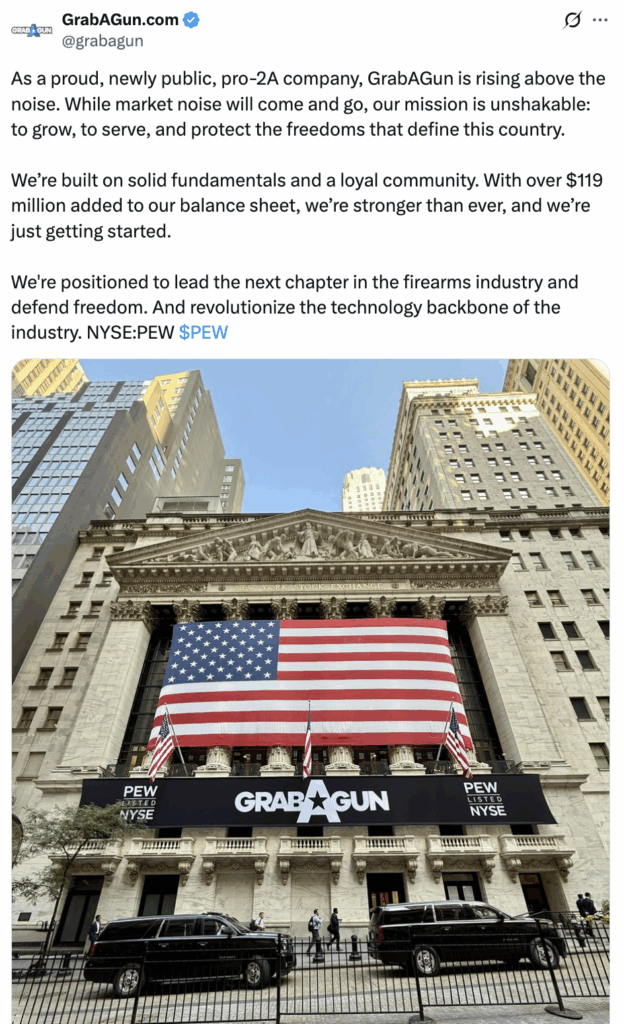

On July 16, 2025, Donald Trump Jr. rang the opening bell at the New York Stock Exchange on behalf of Texas-based online firearms retailer GrabAGun. Trading under the stock ticker “PEW,” GrabAGun went public after merging with Colombier Acquisition Corp. II, a special purpose acquisition company funded by conservative financier Omeed Malik. Shortly after debuting, the stock price plummeted.

More recently, GrabAGun announced that its board of directors had unanimously authorized the repurchase of up to $20 million of the company’s common stock over the next 12 months, indicating that the company thinks its shares (currently trading around $6.80) are undervalued.

despite drop, trump jr. still up millions

As previously reported, Trump Jr. and Malik have promoted GrabAGun as the “Amazon of guns,” courting investors by framing the company as a tech-forward platform for selling firearms, ammunition, and accessories.

Prior to the IPO, most investors had purchased their shares on the open market — potentially at inflated prices fueled by Trump Jr.’s media blitz.Comparisons to Amazon did little to reassure investors after the opening bell, however. After a brief uptick, GrabAGun’s stock plunged nearly 24 percent on its first day of trading. By July 22, shares were down 50 percent. Unlike the typical investor, pursuant to a December 2024 consultant agreement with GrabAGun, Trump Jr. received 300,000 shares of the company. While ordinary shareholders saw hundreds of millions in value wiped out, Trump Jr.’s stake was still reportedly worth $2.5 million as of July 22.

The slide didn’t stop there. By July 29, stocks had fallen over 71 percent, deepening losses for investors and casting further doubt on the company’s valuation. Some analysts have attributed the decline to Wall Street’s skepticism that the company has shareholder value beyond the company’s Second Amendment rhetoric.

leveraging political connections

GrabAGun’s leadership has no shortage of controversial political and firearms industry figures. In addition to Trump Jr., the GrabAGun board includes Colion Noir, a firearms influencer and former NRA commentator; Chris Cox, a former NRA chief lobbyist; Blake Masters, a failed Republican Senate and congressional candidate; and Dusty Wunderlich, a fintech entrepreneur known for promoting “shoot now, pay later” financing for gun buyers.

The company clearly intends to leverage its relationship with Trump Jr. In promoting the company, Malik suggested having Trump Jr. serve as the company’s “avatar of the Second Amendment,” and that his “cult of personality” would help GrabAGun trade “above…where the fundamentals would suggest it would.” One of GrabAGun’s key regulatory filings notes that “[o]ur business may be harmed, in particular, if Donald J. Trump Jr. ceases to be involved with GrabAGun or to support our business and publicize our product offerings.”

Even beyond Trump Jr., the company has notable connections to the Trump administration. Five days after Paul Atkins was sworn in as chairman of the Securities and Exchange Commission (SEC), he attended the April 26 launch party for the Executive Branch, a private club owned by Trump Jr. and Malik. The Executive Branch is a Washington, D.C, conservative social club that reportedly charges a $500,000 entrance fee.

GrabAGun’s rapid market collapse underscores the risks of hype-driven investing — especially when promotion and personality are prioritized over financial fundamentals. While Trump Jr. and his allies positioned the company as a bold new player in the firearms industry, Wall Street responded with swift skepticism. The result: a stock down more than 70 percent in two weeks, deep losses for ordinary investors, and renewed scrutiny of how political connections and public platforms are leveraged for private gain.